Services For Real Estate and Private Equity Insurance

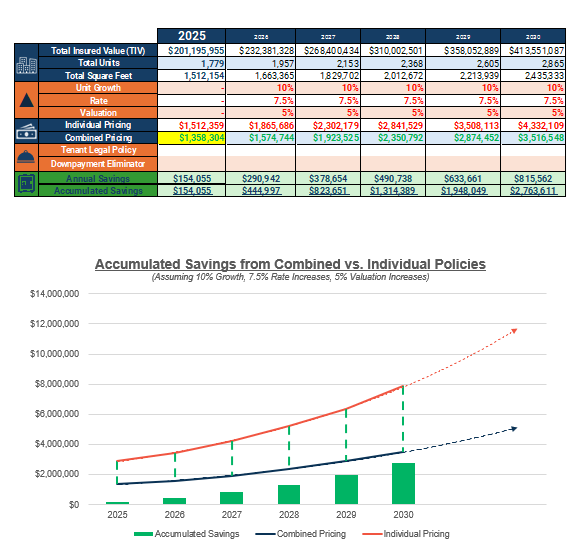

Significant Savings. Lender Liaison. Verified Value.

Significant Savings. Lender Liaison. Verified Value.

Austin Multifamily Investment Firm

San Antonio Multifamily Investment Firm

Texas Private Equity Firm with Portfolio Companies

National Multifamily Owner & Developer

National Investment Firm’s First Property Acquisition